By Patricia Ducey. In 1957, a group of eight California engineers, unhappy at their jobs at Shockley Semiconductors, decided to leave en masse for more compatible environs and wrote to a Wall Street banker for help in finding just the right employer. That banker, Arthur Rock, saw other possibilities and flew out West to convince them to start their own company. He would provide the capital, they would provide the scientific know-how. Later dubbed “The Traitorous Eight” by Shockley, they had to ask Rock what venture capital was and why they would want to start their own company, but they acceded. Rock and his investor and engineers then formed their entirely new company, Fairchild Semiconductors—and Silicon Valley was born.

The new documentary Something Ventured tells their story and numerous others; and it’s as sparkling, sweet—and potent—as a champagne cocktail. Something Ventured is also an unapologetic paean to capitalism, dispensing a much needed corrective to the current cries of “Tax the Rich,” “At some point you’ve made enough money” or “Off with their heads!” All right, I made up that last one, but you get my point.

The new documentary Something Ventured tells their story and numerous others; and it’s as sparkling, sweet—and potent—as a champagne cocktail. Something Ventured is also an unapologetic paean to capitalism, dispensing a much needed corrective to the current cries of “Tax the Rich,” “At some point you’ve made enough money” or “Off with their heads!” All right, I made up that last one, but you get my point.

Producers Paul Holland (a partner himself at a venture firm) and Molly Davis chose Emmy-award winning filmmakers Dan Geller and Dayna Goldfine to helm the film. The able duo mix pop music, priceless old footage and facts and figures with interviews of the now octogenarian money men who funded the future. Holland, and many of the people in the film, aim to inspire a new generation of entrepreneurs—and, perhaps, to gently encourage our government and media to consider the upside of capitalism for once.

But the filmmakers include the downside of the high risk atmosphere of startups, too. The investors note that about half of the original founders of startups are replaced within 18 months of a new corporate structure. Sandy Lerner, a founder of Cisco, recalls painfully how she was fired from the company she loved by the new owner/managers (and how many times has Steve Jobs been fired?), while Tom Perkins and Pitch Johnson recall a few of the inventions that turned out to be duds and companies (termed “the living dead”) that never took off.

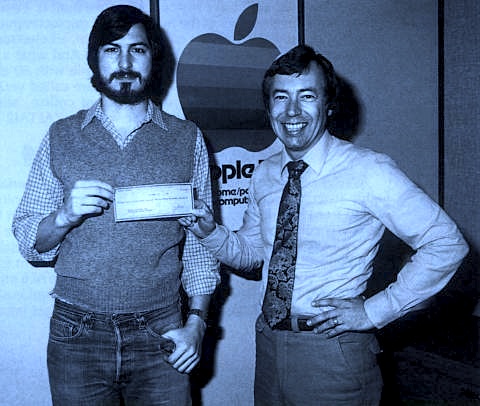

If at times the film feels like a storytelling session with the boys at the coffee shop, that’s because it started out that way. Linda Yates, Holland’s wife, introduced him to the semi-retired investors, and he enjoyed their stories so much he decided to share them. These are men of good humor, optimism and ambition and clearly relish their role as facilitators to the innovators they met along the way. They insist that the entrepreneurs of Apple and Genentech, Cisco and numerous others of their startups, are the real heroes. Their own passion is to create and grow businesses where no business existed before, and they still are spreading the good news today – in their typically larger-than-life fashion. (Pitch Johnson, for one, jumped in his private plane one day in 1970 and flew to Cuba to convince Fidel Castro of the superior benefits of capitalism. No word yet on Castro’s response.)

Many of these new go-go-style businessmen, like Tom Perkins, studied at Harvard Business School under George Doriot, a business professor who saw the human and financial capital in the heady days of post-WWII America and emigrated from France to be part of it. He did fund one startup but, perhaps more importantly, imbued a generation of students with his love for the culture of entrepreneurialism. “I fell for it all, hook, line and sinker,” remarks Perkins, and I’m sure his startups – like Amazon, AOL, Genentech, Google, and Netscape – are glad he did.

Hollywood usually portrays the ‘50s and ‘60s as a time of suffocating conformity and transgressions against many –isms, but Something Ventured is a mostly angst-free look at the time, and we end up feeling that we are living on a trust fund these men and women built. Who could dispute the benefits to society of revolutionizing medicine with gene splicing or of producing the present day 12 million jobs in venture-funded companies, not to mention growing our own 401(k)s? Venture capital since 1960 has parlayed an investment of $450 billion into almost incalculable billions. I don’t have my calculator handy, but I think they beat the vaunted Keynesian 1.5 multiplier the government keeps promising us on their near trillion-dollar “investment.”

So go see Something Ventured at a festival, or perhaps from Netflix (another venture-funded startup). Buy a copy for your home library and for your kids’ schools. The kids will love the old commercials of “home pong,” the first home video game, but they’ll also love learning about vision, hard work, about the adventure of risk and its many rewards. Who knows? Something Ventured might even make optimism fashionable again.

Posted on June 13th, 2011 at 10:37am.

Good review, Patricia. Makes me want to see it even though documentaries are not usually my thing.

Thanks, it’s well worth it.

Note to readers: The Met is presenting an encore performance of Madam Butterfly June 15, at 6:30 p.m. at a theater near you. One of their most incredible!

http://www.fathomevents.com/performingarts/event/madamabutterfly2011.aspx